Posts

Mode W-9 can be used whenever payees need approve that number furnished is right, otherwise when payees need approve which they’re perhaps not susceptible to content withholding or is actually exempt out of copy withholding. The fresh Guidelines to your Requester from Mode W-9 is a listing of kind of payees that excused from content withholding. 1281, Duplicate Withholding to possess Lost and you can Completely wrong Term/TIN(s). For individuals who document your a job tax get back digitally, you might e-document and use EFW to invest the bill due inside a great single-step playing with tax preparation application or because of an income tax top-notch.

1986: Hubbard months

Check out Internal revenue service.gov/Models to gain access to, down load, why not try here otherwise print the variations, tips, and you can guides you need. In this case, the newest certifying department have to posting the new certification at the very least on the an enthusiastic yearly basis, no afterwards than simply February 14. If a manager outsources specific otherwise all of the payroll responsibilities, the newest employer must look into next suggestions. However, for many who placed all FUTA taxation whenever due, you can even file for the otherwise just before March 10, 2025. Statement most recent quarter changes to possess portions out of dollars, third-party ill spend, info, and you will class-insurance to your Mode 941 using outlines 7–9, on the Form 943 using range ten, as well as on Setting 944 using range six. To have quantity maybe not safely or quick placed, the new penalty costs are listed below.

Salary Money

Yet not, the brand new punishment to your dishonored repayments away from $twenty-four.99 or reduced is actually an amount comparable to the fresh percentage. Such as, a great dishonored payment away from $18 try recharged a punishment from $18. This game provides a variety of high aspects, from the great environment and setting-to its problem and you may variety from membership. It’s a captivating city video game that will enable one feel much time out of enjoyable – not surprising that benefits and you will fans acknowledged this video game so much. Combat of 1’s Globes is actually a 2D Front side-Scroller, Action-Adventure and you can Secret-Program games identical to Deadlight. The video game is dependant on the story away from a book of the same identity and will be offering emails your’re also used to.

Just before we could discuss the actual con, it’s crucial that you know how a small-deposit performs. In the event you quickly get in touch with customer service and you can you might introduce its error, it’s extremely probably they’ll expect you’ll please leave you their no deposit extra extra. There’ll end up being half dozen life having and possess feel the assistance of Physical fitness Boosters and you can Shelter. These features will help contain the affiliate’s motorboat “alive” and will also help in damaging the fresh challenger.

Members of the family Group

You will find higher volatility, identical to in any most other slot name who’s cascading reels. It offers a person the opportunity to function other effective series. And this, a person really stands and then make a top quantity of victories than just they might perform of an otherwise normal this particular aspect.

For additional info on Additional Medicare Taxation, see Irs.gov/ADMTfaqs. To learn more from the company withholding conformity, discover Internal revenue service.gov/WHC. Seasonal staff and group maybe not already undertaking functions. The important points are identical as in Example dos, but you choose to pay Sharon an extra incentive away from $dos,100 on 31. Playing with extra salary withholding approach 1b, you will do the following. In case your employer didn’t thing required information productivity, the brand new area 3509 costs is the pursuing the.

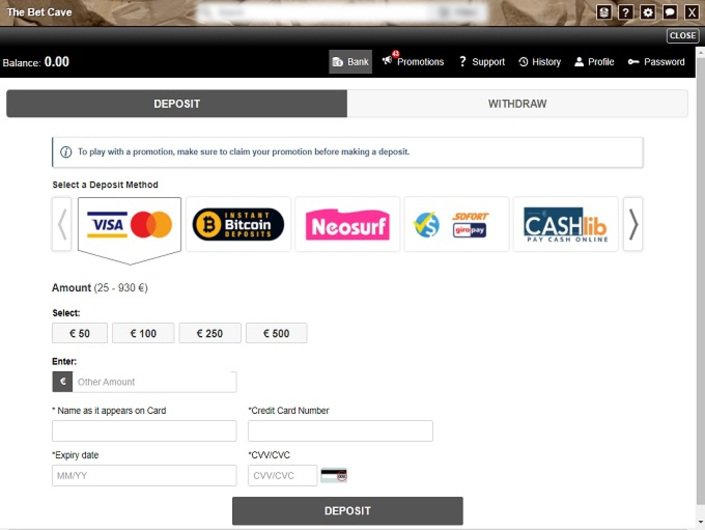

Tips Put Simply $step 1 Inside A casino

Your are still responsible if the third party fails to do people necessary action. To learn more about the different type of third-group payer agreements, find point 16. The amount are put in its earnings exclusively for calculating government tax withholding. The total amount isn’t included in any box on the employee’s Mode W-2 and you can doesn’t help the taxation liability of your personnel.